Benchmark demobilises CleanTreat vessel due to low usage

Integration into wellboats is the long-term solution, says aqua biotech company

Aquaculture biotechnology company Benchmark Holdings has demobilised one of two CleanTreat vessels used in conjunction with its Ectosan Vet lice treatment because of low demand.

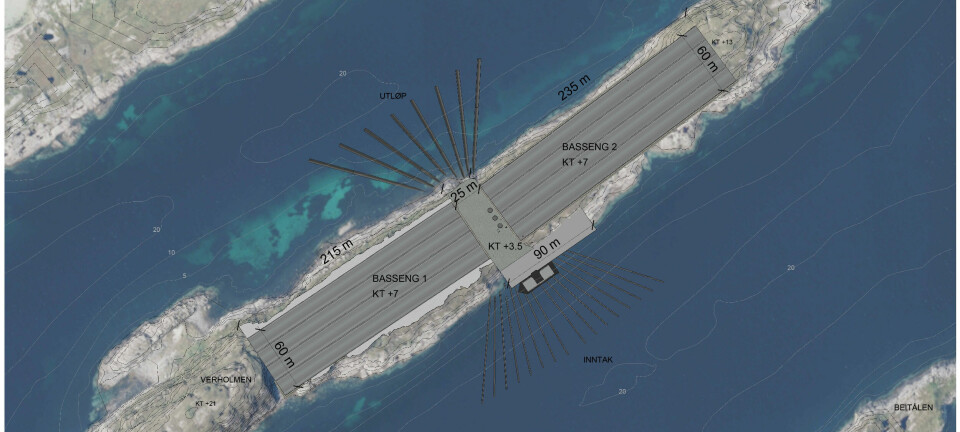

CleanTreat is a water filtration system used to remove Ectosan residues from treatment water. Ecotsan, which contains the neonicotinoid insecticide imidacloprid and is currently only authorised for use in Norway and the Faroes, cannot be used without CleanTreat.

Benchmark has until recently been using two CleanTreat systems housed on vessels that operate side by side with wellboats carrying out Ectosan Vet bath treatments.

Low-capacity utilisation

“In December 2023, we took the decision to demobilise one of the two CleanTreat vessels in light of the low-capacity utilisation,” Benchmark said in its report for the first quarter of its 2024 financial year, which began in October.

“The decision also led to a streamlining of the Health business area, reducing its costs base. As Q2 evolves we will monitor capacity utilisation, prioritising cash management in the transition period until new a less capital-intensive business model is in place.

“We view a model with CleanTreat integrated into wellboats as the medium to long term solution and continue our work to bring this into place. In addition, we are exploring a third configuration for CleanTreat based on a barge in order to provide customers with continuity through a less costly alternative until the wellboat solution is implemented.”

Fish health challenges experienced by customers reduced Benchmark’s earnings from Ectosan Vet in December.

“Health revenues of £6.1m were lower than anticipated as a result of biological challenges faced by certain customers’ fish stock which led to the cancellation of orders of Ectosan Vet and CleanTreat in December,” Benchmark wrote.

£40.5m in revenues

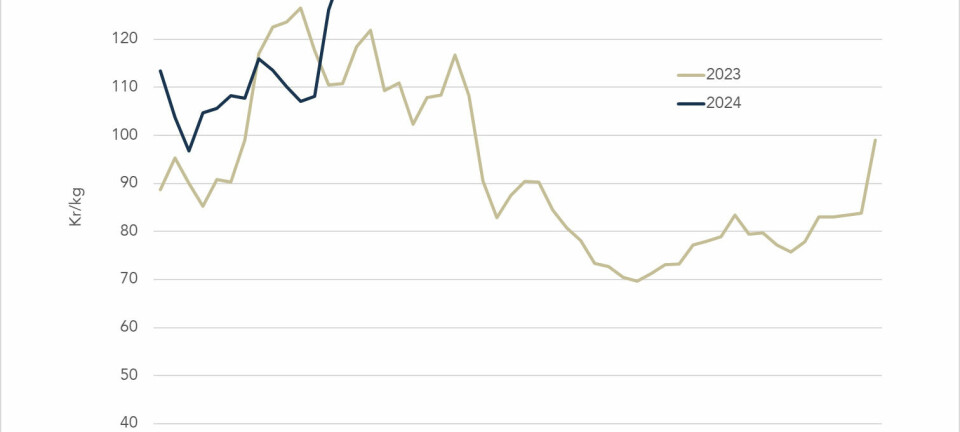

Benchmark’s revenues for Q1 FY24 were £40.5 million, 26% below a particularly strong Q1 FY23, but 11% above Q4 FY23.

The company made an operating loss of £4.4m in Q1, and a post-tax loss of £7.2m, according to the unaudited accounts.

Revenues in Benchmark’s two other business areas – Genetics and

Advanced Nutrition – were also lower than in Q1 FY23.

“Genetics revenues were £15.2m, a solid performance against a strong Q1 FY23 when the Company benefitted from supply constraints of salmon eggs in the market (Q1 FY23: £21.4m),” wrote Benchmark. “Advanced Nutrition revenues were £19.3m, 13% above Q4 FY23 reflecting a solid performance in the context of continuing soft market conditions (Q1 FY23: £22.7m).”

In Genetics, Benchmark said it had growing commercial traction in Chile with revenue growth underpinned by new customers and repeat orders and strong progress towards profitability.

In Advanced Nutrition, there had been strong performance in Europe from marine fish, offset by soft shrimp markets particularly in Asia.

Maintained momentum

Chief executive Trond Williksen said: “We have had a busy quarter where we have maintained momentum in our two largest business areas and the Group is on track to meet management’s expectations for the year.

“We have good visibility of revenues in Genetics, continuing good performance in Advanced Nutrition and have taken actions in Health to transition to a new business model for Ectosan Vet and CleanTreat which will increase its commercial attractiveness and strengthen our portfolio of sea lice solutions.

“We have a busy year ahead and intend to stay focused to deliver continued progress towards our goals. Longer term, as a supplier of specialised mission critical solutions to aquaculture producers worldwide, Benchmark is uniquely positioned in an industry with significant structural growth trends with significant opportunities ahead.”